Get the home you really want.

Never miss another listing when you register and search with Homie.

"Homie does everything you need to buy a home. It was so easy and quick!"

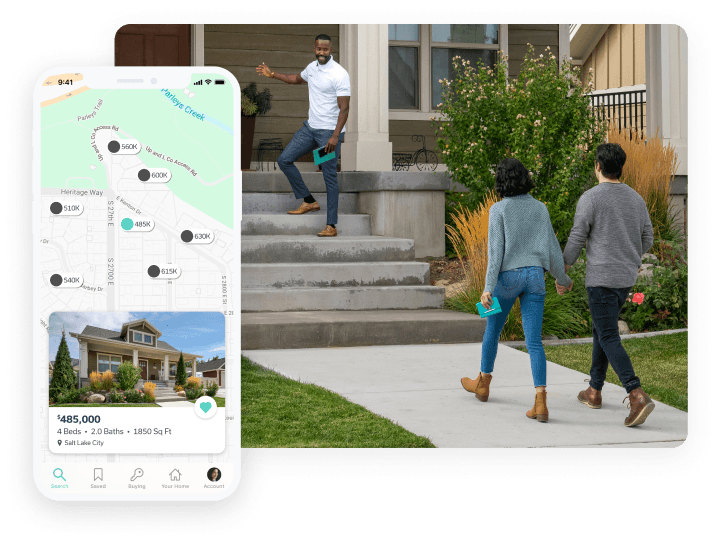

Find Homes First

Get access to Homie listings before they hit the market, and schedule tours on demand.

Get More for Your Money

Get best interest rates from Homie Loans™. On average Homie clients save up to $20,000 when buying and selling a Home.

Buyer Agent

$

You Get Back

$

Traditional Way

Buyer Agent

$

You Get Back

$0

†Terms and conditions apply. Refund calculations based on 3% buyer agent commission.

We've got your back.

Thousands of customers found their dream home with Homie. We can help you find yours.

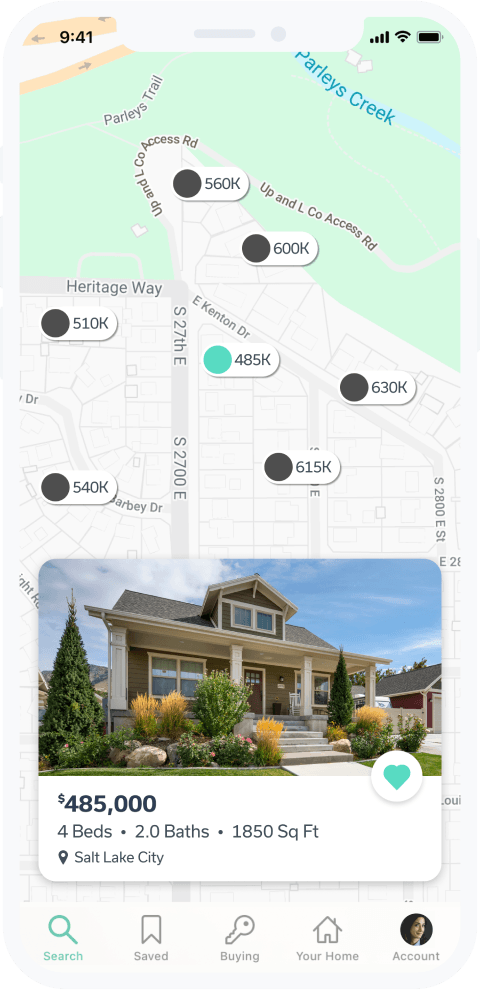

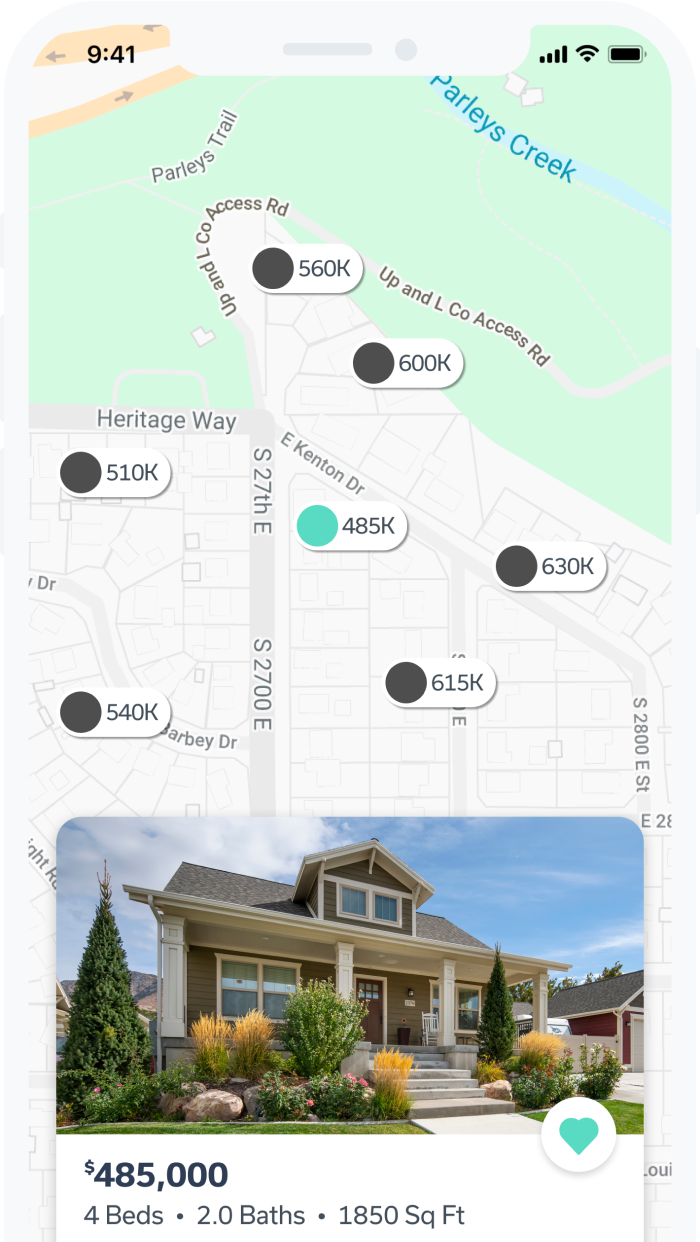

Find Your Home First, Tour it Fast

See homes first and tour homes fast, right from your smartphone. Click to take a tour, an agent meets you at the door.

Never miss a listing again. We’ll alert you anytime a new home hits the market that meets your criteria.

Book tours in the app and see homes fast, often the same day.

Search smarter. Our tech learns all of your dream home must-haves and suggests similar listings you may have missed.

Browse Popular Listings

Guaranteed Best Interest Rate

Using Homie and Homie Loans™ makes your life easy and you'll get the most home for your money*.

Get Prequalified

Your Home is Waiting

Get in touch with a local Homie Buyer's agent now.

†Subject to terms outlined in the Buyer Broker Agreement.

Thanks!

One of our local agents will be in touch with you soon!