Has your credit suffered a hit or two? Before you start thinking rentals, read this.

What mortgage lenders are looking for

You know all about credit scores and that, across the three big credit reporting agencies, scores can really fluctuate. Mortgage brokers and lenders will look at your credit score, toss out the lowest and the highest and typically make decisions based on the score that’s smack in the middle.

But credit scores aren’t the only thing a mortgage lender considers. Other factors affecting loan qualification include:

- Your income

- Debt-to-income ratio

- How long it’s been since you missed a payment

- How long you’ve been in your job

- Ratio of income and projected home payment

In other words, it’s a numbers game that goes way beyond your credit score.

And, if you’re buying with a partner, consider whether or not it’s best to have them on the loan.

If your co-buyer’s credit is crappy and yours is good, you may want to consider removing the co-buyer from the transaction. Realize, however, that the co-buyer’s salary won’t be factored in as income this way. Of course, the co-buyer is still welcome to live in the house with you.

Cleaning up your credit ASAP

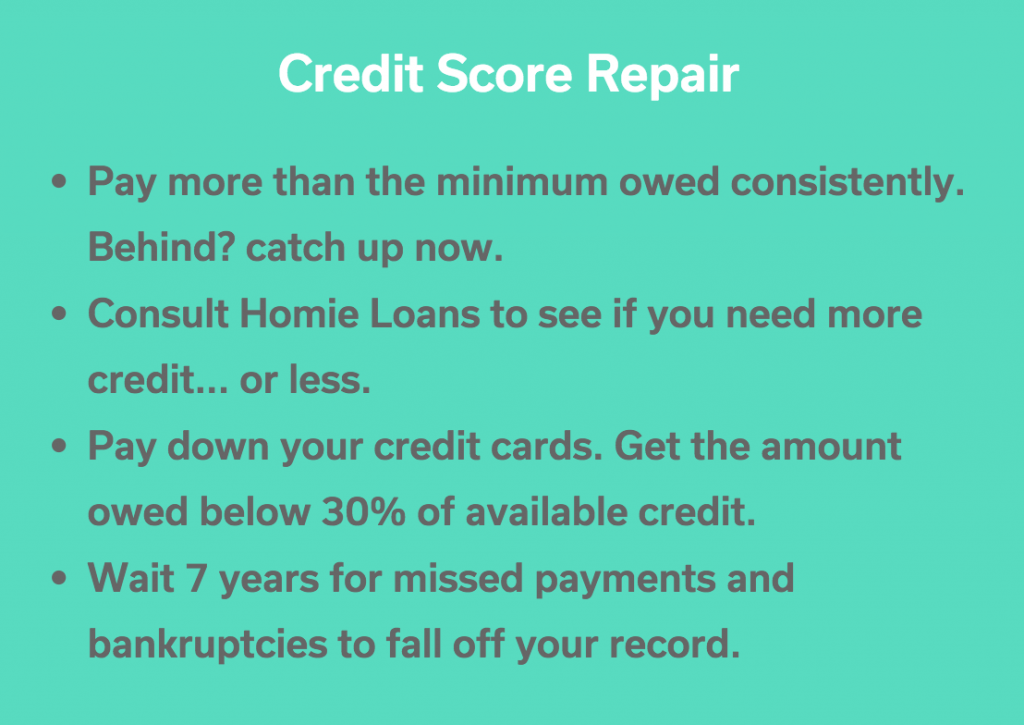

Truthfully, there’s no way to change your credit score overnight. Cleaning up your credit, if it’s not too terrible, can take a few weeks at minimum. If it’s dreadful, expect to spend a few months (even up to a year) playing everything straight in order to get that number to inch a little higher. Fortunately, to purchase a home, you may not need to do either.

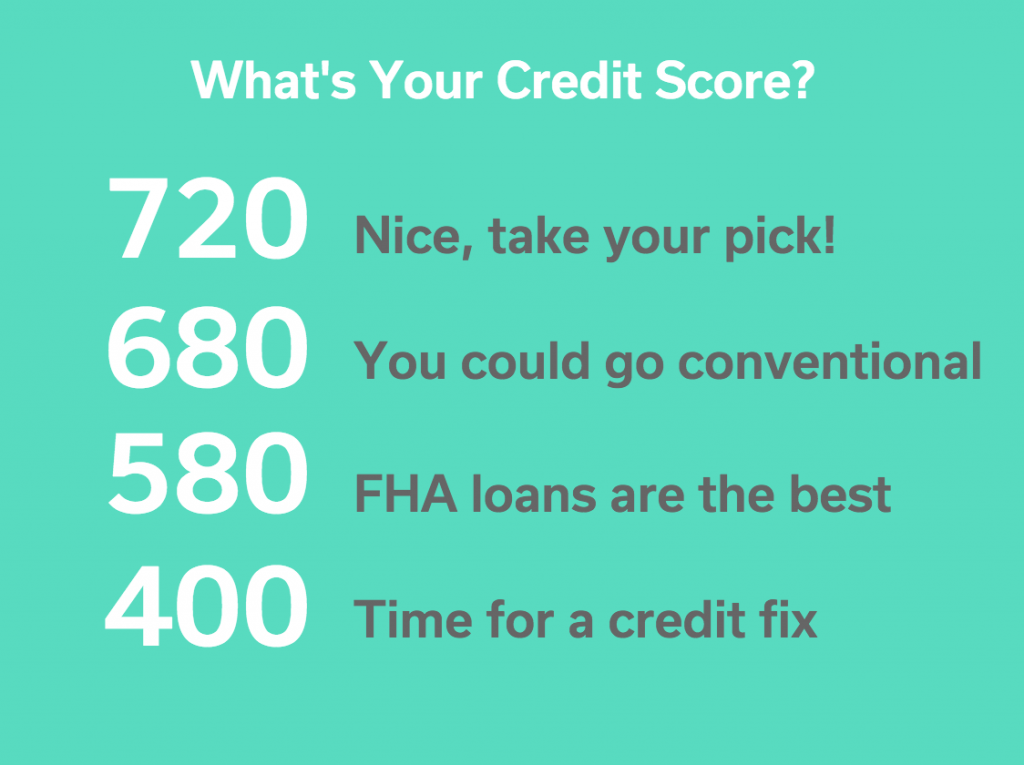

If your score is above 680, odds are good you’ll have no problem. If you’re looking at an FHA loan, 580 should do it (tip: you may get approved with a lower credit score for an FHA loan if you can put more than 3.5% down on your home). For comparison, the lowest possible credit score hovers around 300. FYI, if your score is in the 300s or 400s, you have work to do. Now is not the time to buy a home.

A lender will likely ask you to explain away all the dings on your credit report–for example, why you were late on a payment to your cable TV company (“I took the check to the post office but forgot to drop it in the mail and found it two months later, after disputing the past-due balance. It was paid in full on January 31.”), or why you failed to make a full payment to your car payment a few years back (“I had a large medical bill that I had to pay so I worked with my car loan company to move my February payment to the end of my loan instead.”) As long as you have a legitimate reason that shows why you paid late and that you didn’t walk away from the debt, this may be sufficient to clear up problems in order to obtain the mortgage. These don’t, however, change your credit score.

To really attack your credit score and give it a lift, start by getting a free credit report (yes, these are totally free and should not cost you anything–do NOT pay). You will not receive your credit score in these reports but you will see detailed information about what’s on your credit report. If you spot errors, work with the credit reporting agency directly to clear these up. This usually entails offering proof of some sort that you did pay the bill or that the debt is not yours. Once your dispute or proof is submitted, it usually takes 1-3 months for the score to be affected.

So what home buying options do you have when your credit is in the toilet?

Talk to Homie Loans about your situation and whether any of these options can help get you into a home loan and building equity.

Take on a co-signer/co-buyer: A parent may be willing to share the risk associated with your loan. The co-signer’s credit score will boost the likelihood you’ll obtain the loan, but if you default, the loan is on both of your shoulders.

Put more money into your down payment: When reviewing mortgage-worthiness, your lender will look at how much the home will cost relative to your income and other factors. If you put more money down on the home, your mortgage payment will be lower and can help offset a lower credit score. The same thing holds true for a lower-priced home.

Work with a mortgage broker, not directly with a lender: Whether your credit score is amazing, iffy or somewhere in between, working with a mortgage broker gives you access to more competitive options than mortgage lenders can provide. Mortgage brokers shop around to get the best overall costs/fees/interest scenario or their client’s budget. They’re not linked to a single financial institution, which can only offer that lender’s loan programs. Mortgage brokers frequently have access to wholesale mortgage rates and add their own “commissions” by inching up the interest rates slightly. Homies can tap into low costs and lower-rate loans through Homie Loans, which also accesses wholesale mortgage rates without the higher costs. To your wallet, the difference between Homie Loans and other brokers is frequently the lowest possible interest rate. As a bonus, Homie Loans also currently pays the price of the appraisal for all homes purchased through Homie.com. All in all, you may see both a a short-term reward and a long-term benefit amounting to considerable cash over the life of your loan with Homie Loans.

Extend your mortgage term: Aim for 30 years, the typical length of a first-time mortgage in the U.S., instead of a 15- or 20-year loan. Your payments will be lower, which can help you qualify for a loan more easily. Talk to your mortgage broker for more details.

Consider unique loan programs: Few of the truly odd or unique loans exist today (some of these probably helped usher in the mortgage crises), but checking with a mortgage broker before you start looking at homes can help you determine if you’re eligible for other programs like a VA loan that doesn’t factor in credit scores, a USDA/rural loan that requires no money down, or another unique home loan program.

Rent-to-own and owner financing: While you’ll still need to qualify, rent-to-own and owner-financing agreements can be great options for wanna-be homebuyers who can’t obtain a loan. Unfortunately they’re very hard to come by and you won’t be able to go through a mortgage broker or lender for either one. Your best bet is to luck into one of these, usually because you’re buying from family a close friend.

Should you sign a lease or buy a home if your credit is bad?

It’s true that poor credit can affect where you live, regardless of whether you’re renting a home or buying one. Before you decide to rent again, check with a Homie Loans mortgage broker to see if you qualify for a home loan. If the answer is “yes” (and stats say it’s likely–a 2015 report indicated the average credit score in Utah was 677; nationwide, Millennials had a score of 625; older generations had higher scores), go month-to-month on your lease. Then start the process by getting pre-approved for a loan and start shopping for the home you really want to live in. Get pre-qualified.

Homie Loans is a Equal Housing Lender, NMLS# 1016597