My neighbor Leslie G. and her husband Doug decided to sell their house. Nestled at the end of a cul-de-sac in Murray, their coveted lot bordered a lush green common area that led to a creek. Nice. Leslie was also a master gardener and the home featured curved brick walkways, an outdoor fountain, and easy-to-care-for perennials. It had serious curb appeal. Based on an appraisal and neighborhood comps, they were hopeful they could get $400,000 for their home. But that was just their beginning point. By employing the following strategies, they ended up accepting an offer $35,000 higher and everyone was happy, including the buyer.

Seller strategies for a scorching market

Clean it and stage it. The G’s had a full life with kids, grandkids and worldwide travels. Their home was equally full. When I walked through the home prior to their listing going live, it was difficult to separate the G’s from their home because personal items were in every room and on every wall. It also reflected a specific style and had the wear and tear of most houses built in the 90’s. A stager spent an hour in the house telling Leslie what to do, then Leslie and Doug spent an entire week cleaning, painting and adding new decor items in select locations. The results were staggering. Cluttered surfaces were cleared. Windows sparkled and sunlight streamed in. An outdated master got a complete refresh with a new bedspread, towels, and rugs. Each room boasted one salient piece of artwork, other than that walls were bare and the wall holes filled in and painted. Fresh flowers and bright new pillows graced the deck and every inch of baseboard in the house was scrubbed to a bright white gleam.

The staged deck has half its normal furniture

Why it’s smart: By removing most of the furniture and all of the personal effects from the house and deck, your house will feel emotionally neutral and move-in-ready. Buyers don’t need to try to imagine the space without your things there, they can see it. And fewer pieces of furniture typically makes a space or room look much larger than its crowded counterpoint. On Homie’s Provider Marketplace, you can find repairmen, stagers and cleaning teams to help you accomplish this quickly and easily.

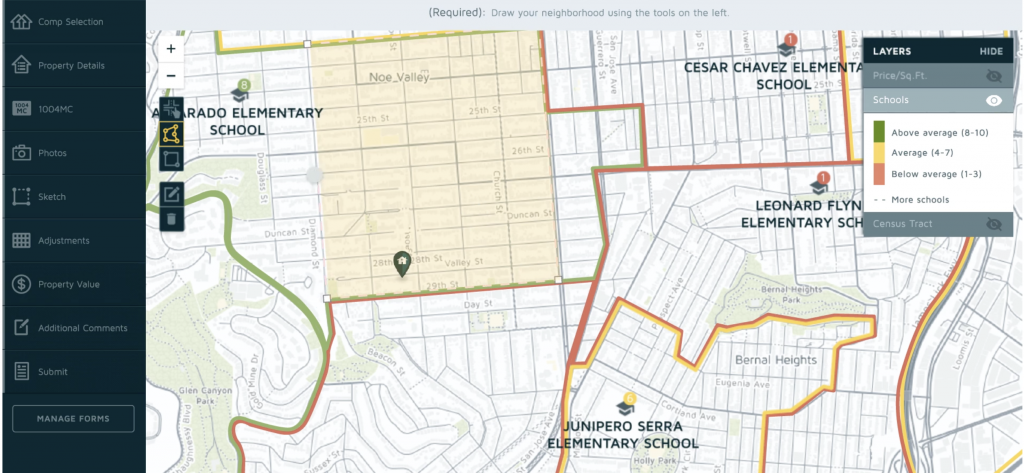

Price at or above appraised value. Utah home prices are shooting up faster than bamboo, and desperate buyers are often willing to offer more than even 3-month old comps. Leslie and Doug decided to price their home above its appraised value, feeling that the appraisal did not adequately take the prime location into account.

Appraisals can vary considerably

Why it’s smart: No two appraisals come in at exactly the same value, and sometimes the value can range considerably. In addition, in a market where the housing shortage is forcing prices up above appraised value, your buyers might have enough liquidity so that a below-sale-price appraisal is a none issue. If it does become an issue, you can discuss your options with your Homie attorney. Even if you split or pay the entire difference, you still end up earning top dollar on your home. If you set the price at appraised value, you open the negotiations to buyers who have less to put down, which might serve you well if your home entices first-time buyers. Homie gives sellers appraisal options, including but not limited to a Home Value report, desktop appraisal and more.

Give yourself time to consider multiple offers. The G’s listing specified that they would only accept offers with a seller acceptance deadline at least 72 hours after submission. A common practice of today’s home buyers is to “rush” sellers into accepting their offers before other interested buyers have a chance to tour the house and place an offer. Not surprisingly, the G’s received two offers within a week. They asked both potential buyers to come back with their “highest and best offer,” both of which were above listing price. They also continued to show the house, which ended up being a very good idea.

Building in a 72-hour window gives you time to get your highest and best offer

Why it’s smart: By requiring that offers have a 72-hour acceptance window, you build in time to receive multiple offers. This doesn’t mean buyers can’t make an offer with a shorter deadline, and if you get a “rushed” offer that makes you happy, by all means, accept it. Still, a 72-hour clause sets the expectation for buyers that you know your house is going to sell and will likely have multiple offers. It also gives you time to ask interested parties to come back with their highest and best offer. They may choose not to make an additional offer, so check with your Homie attorney about the best way to phrase a highest-and-best-offer request. If they do come back with their best offer, check to see that their downpayment amount is large enough that the appraisal will not likely be a problem.

Avoid buyers making offers higher than they’re actually willing to pay. Leslie and Doug didn’t want to get weeks down the road with an offer and then have to renegotiate. When they received offers that were contingent upon a certain appraisal amount, they took care to make sure those buyers were not using high bidding prices to secure the home while planning on renegotiating if the appraisal came in below the sales price. Both buyers ended up backing out of their offers, and the G’s were free to consider other offers that met their requirements. A few days later, they received a third offer from a family they felt would be a great fit for both the house and the neighborhood. They ended up accepting this third offer, which was not contingent upon an appraisal amount.

If you’re concerned about the appraisal, consider buyers with enough liquidity to avoid shortfall issues

Why it’s smart: Buyers are doing their best to find an affordable house, however, in such a hot market it does happen that buyers offer more than the house appraises for. In considering multiple offers, ask your Homie attorney to help you structure your contract to protect yourself against a potential shortfall.

Only accept offers from pre-approved, not pre-qualified, buyers. An offer is only attractive if the buyer can actually close. It’s unfortunate, but many sellers have accepted the “highest offer” only to see the loan fall through and find themselves back on the market two or three weeks later. Today any buyer can get a pre-qualification letter just by entering a few fields into an online platform and allowing a hard pull on their credit, but at this point they have provided no actual income or debt documentation.

Ask your buyers to get pre-approved, so you don’t have to start over 3 weeks into the sale

Why it’s smart: When you ask your buyers to go the extra step from pre-qualification to pre-approval, you know, not only that they’re qualified to buy your home, but also that they can and have provided all the documentation required by the lender to get approved for the loan. And, while they haven’t yet gone through underwriting, which requires a specific contract on a specific house, they can get all the way to that point, which strengthens their offer considerably. Pre-approval status also shortens the amount of time needed prior to a financing and appraisal deadline, which can shorten your closing while also reducing your risk. You can ask interested buyers, even pre-qualified buyers, to get pre-approved at Homie Loans, putting yourself in the best possible position.

In a market like this, use Homie

Yes, it’s a seller’s market, but that doesn’t mean showing your house dirty or cluttered will get you your best price. It also means different strategies come into play when considering, countering and accepting offers. Homie provides seasoned real estate attorneys to help Homie sellers understand the nuances of today’s market and negotiate each step of the process with confidence. To list your home with Homie, and speak to a real estate attorney about how you can get the best deal possible for your home, start here.

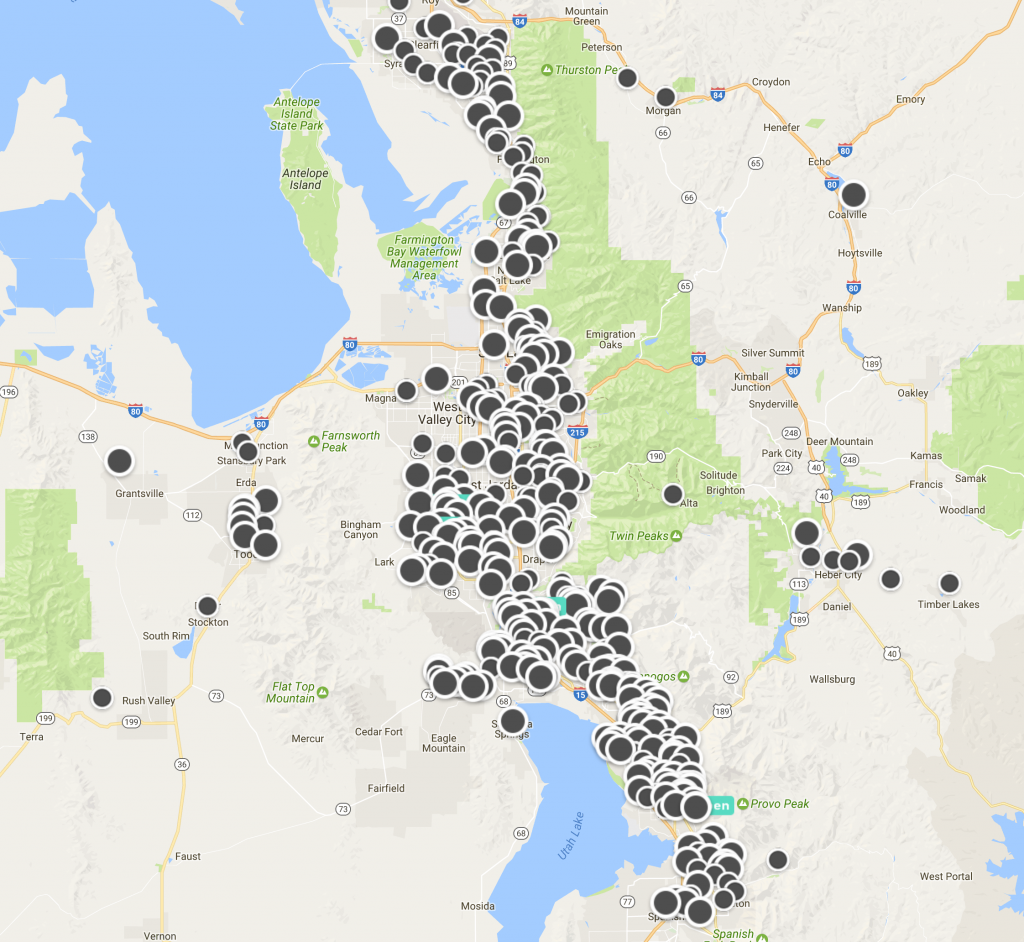

Word’s out. Homie has hundreds of new zero-commission listings every month.