Get the home you really want

Talk to your dedicated agent about a buyer rebate*

“The process couldn’t have gone any smoother. Everything with Homie was simple and efficient.”

How Buying With Homie Works

The simplicity and transparency of an app and the expertise and guidance from an agent.

We've got your back.

Thousands of customers found their dream home with Homie. We can help you find yours.

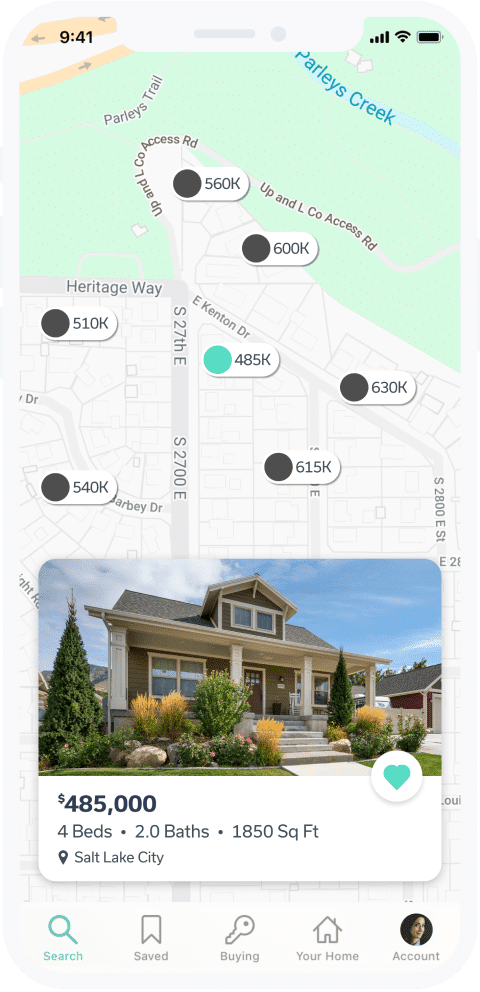

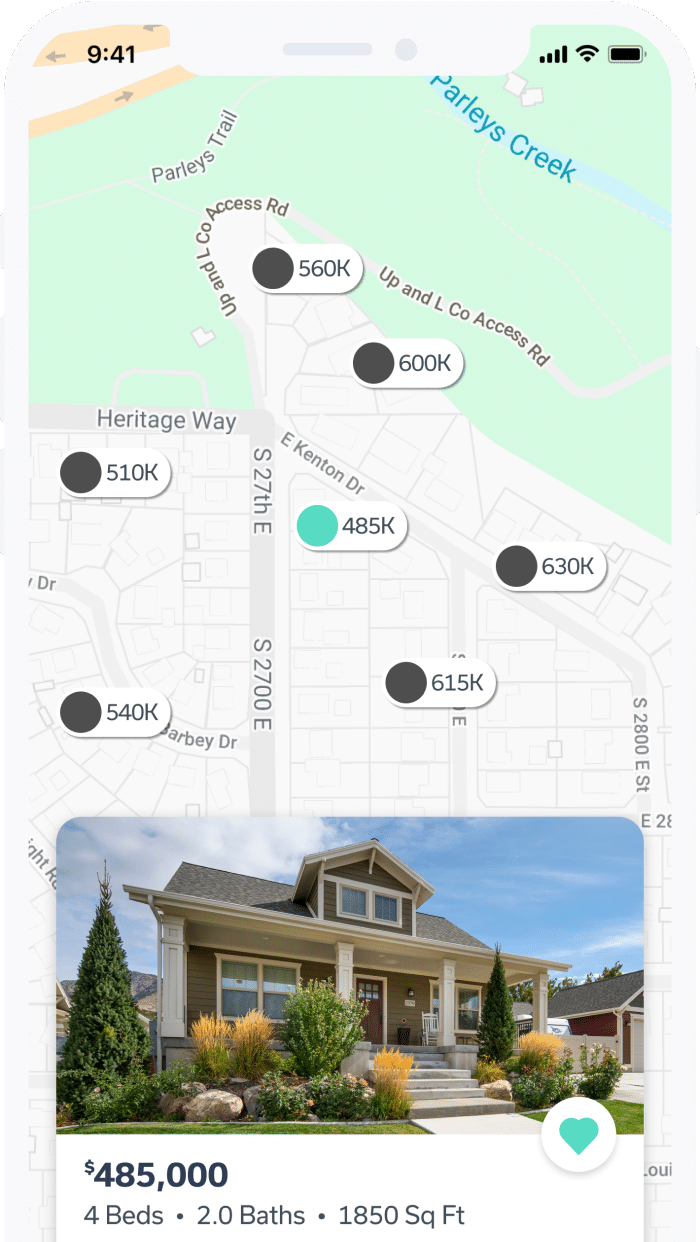

Find Your Home First, Tour it Fast

See homes first and tour homes fast, right from your smartphone. Click to take a tour, an agent meets you at the door.

Listing Alerts

Never miss a listing again. We’ll alert you anytime a new home hits the market that meets your criteria.

Tour Scheduling

Book tours in the app and see homes fast, often the same day.

Recommended Homes

Search smarter. Our tech learns all of your dream home must-haves and suggests similar listings you may have missed.

Your Home is Waiting

Get in touch with a local Homie Buyer’s agent now.

†Subject to terms outlined in the Buyer Broker Agreement.